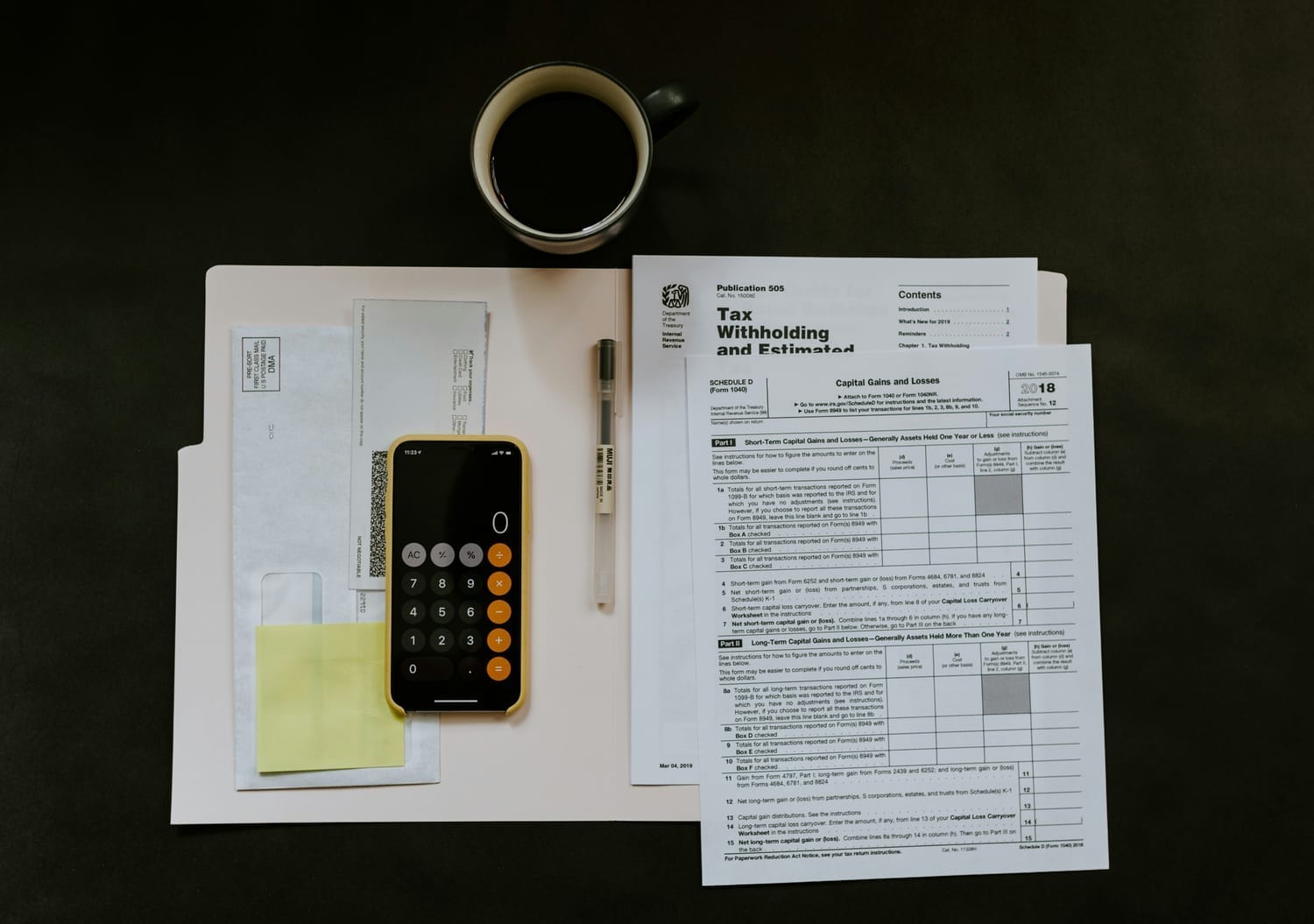

Tax Preparation Services

tax preparation

Individual & business tax filing with accuracy, compliance, and care

TAX SOFTWARE SOLUTIONS

Professional tax software solutions for preparers and firms.

Leadership Coaching by Flexing Forward Coaching

Professional development support for entrepreneurs and leaders

ABOUT US

Braden Services Taxes is a full-service virtual tax preparation firm serving Northern Virginia and clients nationwide. With over 10 years of professional tax experience, we specialize in individual and business tax preparation, delivering accurate, compliant, and personalized services directly to our clients wherever they are.

We combine the convenience of modern technology with the personal attention of a trusted advisor. Our experienced team is dedicated to maximizing tax benefits, simplifying complex tax matters, and providing peace of mind throughout tax season and beyond.

Mission

To empower individuals and businesses with expert, accessible tax preparation services that maximize financial benefits and minimize stress. We are committed to advancing the tax preparation industry through innovative software solutions that elevate the standards of professional service.

Vision

To be a trusted partner in financial success by building lasting client relationships rooted in expertise, integrity, and care. We envision a future where individuals and businesses feel confident, supported, and empowered to make informed tax decisions with clarity and peace of mind.

FREQUENTLY ASKED QUESTIONS

No. Braden Services does not guarantee refund amounts or specific results. All work is based on accurate reporting and current tax law.

Yes. Services are available virtually, and in-person appointments may be available by request.

Required documents vary by filing situation but may include identification, income documents, prior-year returns, and supporting records. Clients will receive a document checklist after scheduling.

Our software is designed for professionals and serious users. Support and guidance are provided where applicable.

Flexing Forward is ideal for professionals, entrepreneurs, and individuals seeking structured guidance and strategic clarity in business and life.